Angel and seed funding in Europe are remarkably resilient to the startup market downturn, according to new research by Pitchbook.

In the first half of 2021, both median deal values and valuations in these stages exhibited positive trends. The biggest increase was in median angel deal values, which were up 28.8% compared with 2022. The median angel valuation, meanwhile, was up 10.2%, while the median seed-stage valuation was flat.

These figures illustrate the insulated nature of early-stage funding. Angel and seed rounds are typically more removed from public markets, as businesses at those stages are further away from maturity and exit. Because the returns tend to be long-term, investors in these rounds are less dependent on temporary market frailties.

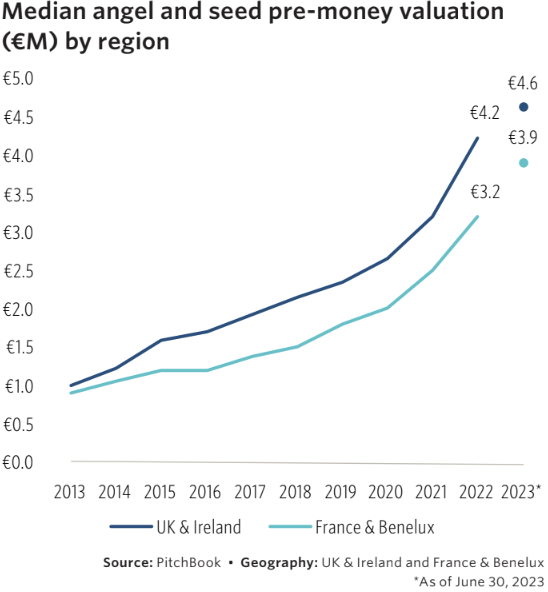

Public funding programs have also helped. The growth of angel and seed stages in the UK, Ireland, France, and Benelux was partly credited to government initiatives, such as SEIS and the FCPI.

Catch up on our conference talks

Watch videos of our past talks for free with TNW All Access →

Pitchbook expects angel and seed valuations to remain relatively insulated from near-term market volatility. In later rounds, however, the signs are less encouraging.

At the venture-growth stage, times are particularly tough. In the first half of 2023, median venture-growth valuations and deal value paced at 18.5% and 16.7% below their full-year medians from 2022, respectively.

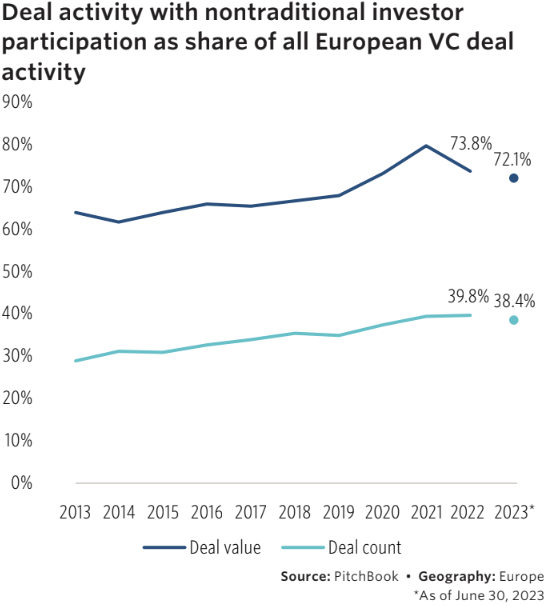

One factor behind this decline is the role of nontraditional investors, such as investment banks, private equity firms, and pension funds.

In previous years, these investors boosted competition, round sizes, and valuations at the venture-growth businesses, which often have similar operations to large public companies. But in H1 2023, deal value with nontraditional investor participation dropped from €27.8bn to €18.7bn.

That may reflect attentions shifting to early-stage funding. The proportion of deals with nontraditional participation has stayed at around 38% since 2021 — which suggests they’re focusing on smaller, earlier rounds where deal value is lower.

Despite the early-stage resilience, the broader funding landscape remains immensely challenging.

Down rounds, for instance, have become far more common. In Q2, 26.2% of company valuations were lower than in the previous funding round. A notable example is Turkey’s Getir, which was hit by a 42.4% decrease in valuation in Q2 2023.

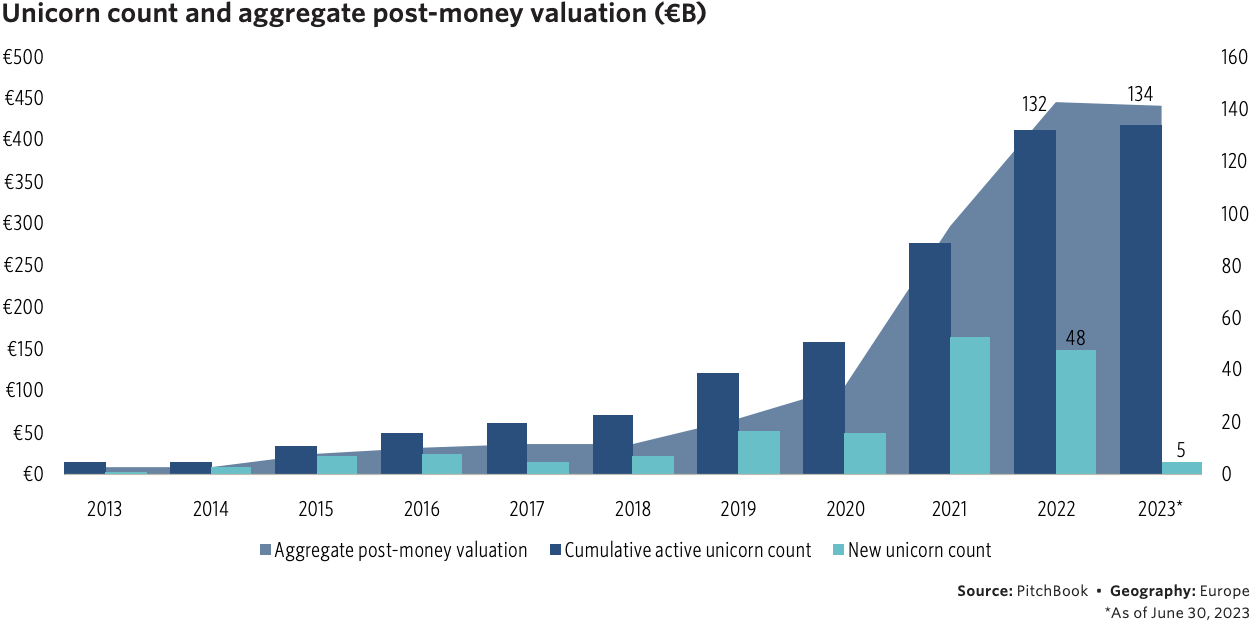

Unicorn activity, meanwhile, has been constrained. There are currently 134 privately-held startups in Europe valued at least €1bn, but only five have emerged since the end of 2022 — a rate markedly lower than in the previous two years. To mitigate this decline, Pitchbook recommends more support from government funds for venture-growth companies.

Exit valuations have also plunged. The median valuation fell from €33.9mn in the first quarter of the year to €17.3mn in Q2. Macroeconomic factors — namely interest rates — are driving the dip.

Pitchbook expects further corrections to be lumpier with a lag to public equities, which means it’s too early to assume that the declines have reached the bottom. As a result, stakeholders will need patience and extended runways to manage the industry’s loss of liquidity and capital.