The digitisation of cars has made comparisons to “data centres on wheels” so common that they’ve become clichéd. It’s also built a booming market for tech firms — few of which have capitalised as adeptly as Arm.

Often described as the UK’s leading IT company, SoftBank-owned Arm designs energy-efficient computer chips. The company’s architectures are found in endless applications, from smart cities to laptops, but they’re best-known for powering mobile devices. Around 95% of the world’s smartphones use Arm’s technology.

In recent years, however, the company’s fastest-growing division has been the automotive unit. Arm has reportedly more than doubled its revenues from the sector since 2020.

Dennis Laudick, Arm’s vice president of automotive go-to-market, attributes the growth to a convergence of three trends: electrification, automation, and in-vehicle user experience (UX).

Join us at TNW Conference June 15 & 16 in Amsterdam

Get 20% off your ticket now! Limited time offer.

“All of those are driving more compute into the vehicle,” he says — and more compute means more business for Arm.

As the company prepares for a long-awaited public listing, Laudick gave TNW a glimpse into his automotive strategy.

Electric avenues

Gradually, EVs are engulfing the car market. Last year, fully-electric vehicles comprised over 10% of car sales in Europe for the first time. Globally, their total sales hit around 7.8 million units — as much as 68% more than in 2022. To serve this growing market, automakers have to integrate a complex new collection of electronics.

“When you do that, it becomes a lot more complicated system,” says Laudick. “You need to look at even more electronics to manage it, and that causes people to rethink their architectures.”

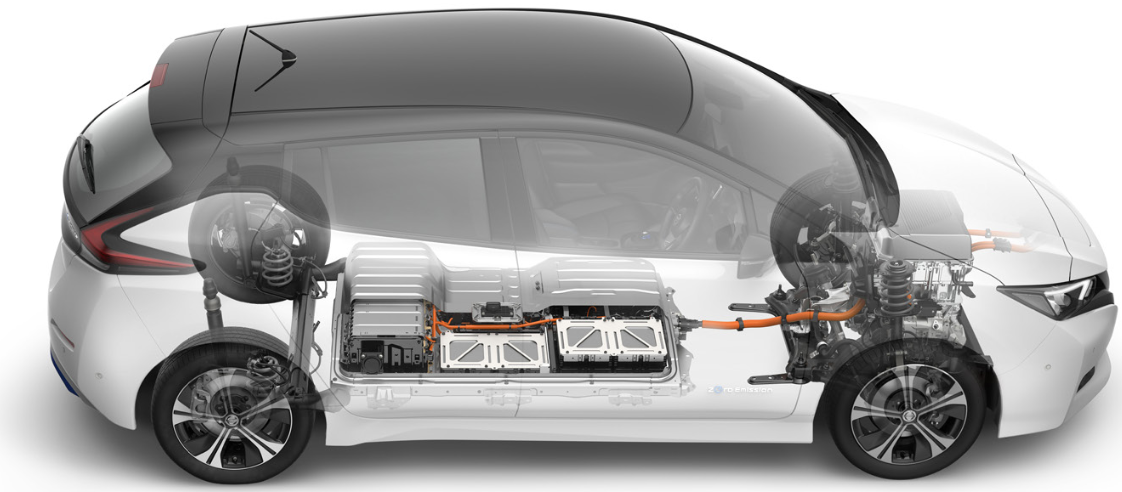

The result is firmer foundations for more digital features. Take the all-electric Nissan Leaf, which runs Arm’s Cortex-R4 processor alongside an electric powertrain.

To control the power inverter, a microcomputer core has to accurately repeat a series of processes — such as sensing, calculation, and control output — for events that occur in 1/10,000-second cycles. In this tiny computation window, the system has to deliver efficient, responsive, and precise control.

The Leaf also has a new electronic pedal system, which the driver uses to control the car’s speed by applying pressure to the accelerator.

When the accelerator is fully released, regenerative and friction brakes are activated automatically, bringing the car to a complete stop — even on steep slopes — until the accelerator is pressed again. And if the driver gets tired, an intelligent cruise control system can automatically match the car’s speed to the flow of traffic, while a lane assist feature makes subtle steering corrections to keep the vehicle centred.

It’s a convenient package of features, but one that reimagines the whole foundations of a car. The likes of Nissan had spent decades establishing the controls and architectures that run internal combustion engines (ICEs) for decades. They’re now rapidly replacing their hardwarewith digital operations. The shift has fostered a concept called the “software-defined vehicle.”

“The whole industry is aware of this disruption that’s converting them from a mechanical mindset to a software mindset — and they’re all trying to reinvent themselves,” says Laudick.

“It equates to more powerful electronics.

Undoubtedly, the transition has opened up new business opportunities for Original Equipment Manufacturers (OEMs), component suppliers, startups, and semiconductor companies. But all the new features and revenue streams have to fit within the tight constraints of power consumption, heat dissipation, and physical space.

That’s where Arm wants to step in. The company’s suite of processor IP, tools, and software solutions offers the automotive sector the promise of maximising innovation.

“From our perspective, it basically equates to more electronics — and more powerful electronics,” says Laudick.

Autonomy rules

The transition to EVs has coincided with an expansion of autonomous features. While level 5 cars haven’t arrived as quickly as advertised, advanced driver assistance systems (ADAS), from lane detection to park assist, have become commonplace. As a result, the applications for Arm’s architectures are proliferating.

“The more autonomous functionality we drive into cars, the more exponential the compute demands are,” says Laudick. “And if you look at some of the data systems that people are looking at putting in cars in five years’ time, they’re really high-end.”

At present, Arm powers everything from processors that Dream Chip Technologies applies to radar to smart electronic fuses that Elmos uses to supply stable power. As the use cases expand, so does the demand for chips — and the rules that surround them.

Both EVs and autonomous features are being pushed by regulators. Governments are encouraging electrification for environmental reasons, and autonomy for accident prevention.

In the EU, several safety features will soon become compulsory. The European Parliament has made measures including intelligent speed assistance (ISA), advanced emergency braking, and lane-keeping technology mandatory in new vehicles from May 2022.

“This will make all of us safer.

The lawmakers made a compelling case for their intervention. In 2018, around 25,100 people died on EU roads, while 135,000 were seriously injured. According to EU estimates, ISA alone could reduce the fatalities by 20%.

“ISA will provide a driver with feedback, based on maps and road sign observation, always when the speed limit is exceeded,” said MEP Róża Thun, who steered the legislation. “We do not introduce a speed limiter, but an intelligent system that will make drivers fully aware when they are speeding. This will not only make all of us safer, but also help drivers to avoid speeding tickets.”

It’s a similar story for electric vehicles. According to the European Commission, cars are responsible for 12% of total CO2 emissions in the EU. To mitigate the impact, the union recently approved a law requiring all new cars sold from 2035 to have zero CO2 emissions. In addition, already from 2030 their emissions must be 55% lower than they were in 2021.

The targets aim to accelerate electrification. In theory, this should benefit drivers, passengers, pedestrians — and Arm.

Getting flexible

As automotive compute shifts from hardware to software, demand is growing for infotainment and cockpit features. According to Arm, more than 90% of in-vehicle infotainment (IVI) systems use the company’s chip designs. The architectures are also found in various under-the-hood applications, including meter clusters, e-mirrors, and heating, ventilation, and air conditioning (HVAC) control.

The shift to the software-defined vehicle has also stimulated another IT feature: updates. Historically, vehicle software was not only rudimentary, but also fairly static. Today, that’s no longer the case.

“There’s an opportunity to continue to add to the functionality of the vehicle over its lifetime,” says Laudick.

An expanding range of features, from sensor algorithms to user interfaces, can now be enhanced over-the-air (OTA). As cars begin to resemble personal devices, consumers can expect a comparable update service. As Simon Humphries, the chief branding officer of Toyota, put it: “People want control over their own experiences.”

Laudick likens modern cars to platforms, upon which software and functionality can evolve. That’s an obvious magnet for Arm, whose products and processes are fundamentally about running software.

Carmakers are also becoming savvier about software. For example, General Motors’ self-driving unit, Cruise, is now developing its own computer chips for autonomous vehicles. The company has previously used Arm designs, but is now exploring an open-source architecture known as RISC-V — which is becoming a popular alternative. The instruction set’s low costs and flexibility have created a threat to Arm’s automotive ambitions.

“One executive I was talking to said: ‘The best negotiating strategy when Arm comes in is to have a RISC-V brochure sitting on my desk’,” Jim Feldhan, the president of semiconductor consultancy Semico Research, said last year. “It’s a threat. Arm is just not going to have its super dominant position in five or 20 years.”

“There’s been a move to create more flexibility.

Currently, however, RISC-V could be regarded as riskier than Arm’s established standards. In a further challenge to RISC-V, Arm is gradually becoming more open. The Cortex-M processor series, for instance, now allows clients to add their own instructions, while extra configurability has been added to Arm software and tooling.

“We obviously try to control the products reasonably well, otherwise we just end up with a wild west. But there’s been a move in the company in the last several years to create more flexibility in certain areas,” says Laudick.

RISC-V is far from Arm’s only challenger. Established rivals such as Intel and Synopsys are also fighting for a chunk of the expanding market for automotive chips.

Nonetheless, Laudick is bullish about the future. He notes that today’s cars run about 100 million lines of software code, while a Boeing 787 is estimated to have “only” 14 million. By 2030, McKinsey predicts that vehicles will expand to roughly 300 million lines of code.

“I see the vehicle being, without doubt, the most complex software device you will own — if not that will exist,” says Laudick.