After a previous version of this guide put face-to-face chips from Qualcomm, MediaTek, Apple, Samsung, and Huawei/HiSilicon, a bunch of things changed in the smartphone component arena, notably the arrival of Google, the death of flagship chips from Huawei due to US sanctions, and Samsung going on a hiatus from the flagship space. First, let’s take a look at an overall specs comparison of today’s contestants.

Snapdragon vs. Dimensity vs. Exynos vs. Tensor vs. Apple: Specs Compared

| Late 2022 ~ Early 2023 | Late 2021 ~ Early 2022 | |||||||

|---|---|---|---|---|---|---|---|---|

| Qualcomm | MediaTek | Apple | Qualcomm | MediaTek | Samsung | Apple | ||

| Product |

Snapdragon 8 Gen 2 |

Dimensity 9200+ |

A16 Bionic |

Tensor G2 | Snapdragon 8+ Gen 1 | Dimensity 9000+ | Exynos 2200 | A15 Bionic |

| Prime core | 1x Cortex-X3 @ 3.36 GHz | 1x Cortex-X3 @ 3.35 GHz | – | 2x Cortex-X1 @ 2.85 GHz | 1x Cortex-X2 @ 3.2 GHz | 1x Cortex-X2 @ 3.2 GHz | 1x Cortex-X2 @ 2.8 GHz | – |

| Performance core | 2x Cortex-A715 @ 2.8 GHz 2x Cortex-A710 @ 2.8 GHz |

3x Cortex-A715 @ 3.0 GHz | 2x Everest @ 3.46 GHz | 2x Cortex-A78 @ 2.35 GHz | 3x Cortex-A710 @ 2.75 GHz | 3× Cortex-A710 @ 2.85 GHz | 3x Cortex-A710 @ 2.52 GHz | 2x Avalanche @ 3.24 GHz |

| Efficiency core | 3x Cortex-A510 @ 2 GHz | 4x Cortex-A55 @ 2.0 GHz | 4x Sawtooth @ 2 GHz | 4x Cortex-A55 @ 1.8 GHz | 4x Cortex-A510 @ 2.0 GHz | 4× Cortex-A510 @ 1.8 GHz | 4x Cortex-A510 @ 1.8 GHz | 4x Blizzard @ 2.0 GHz |

| GPU core | Adreno 740 | 11x Immortalis-G715 | 5x custom GPU | 7x Mali-G710 | Adreno 730 | 10x Mali-G710 | AMD Xclipse 920 | 5x custom GPU |

| 5G modem | Snapdragon X70 (10/3.6 Gbps) |

Helio T800 (7.9/4.2 Gbps) |

External (Snapdragon X65) |

Exynos 5300 (10/3.87 Gbps) |

Snapdragon X65 (10/3 Gbps) |

Helio (7/2.5 Gbps) |

Exynos 5123 (7.35/3.67 Gbps) |

External (Snapdragon X60 / X65) |

| WLAN | Wi-Fi 7 | Wi-Fi 7 | Wi-Fi 6 | Wi-Fi 6E | Wi-Fi 6E | Wi-Fi 6E | Wi-Fi 6 | Wi-Fi 6 |

| Bluetooth | 5.3 | 5.3 | 5.3 | 5.2 | 5.3 | 5.3 | 5.2 | 5.3 |

| Process node | TSMC N4 | TSMC N4P | TSMC N4P | Samsung 5LPE | TSMC N4 | TSMC N4 | Samsung 5LPE | TSMC N5P |

SoC parts

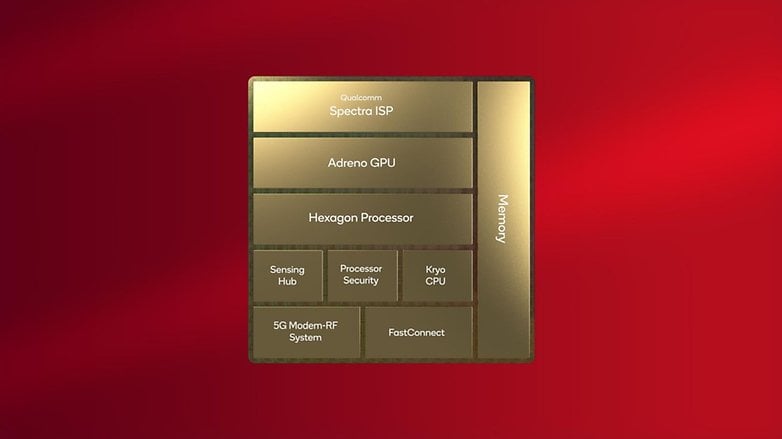

Mobile system-on-chip (SoC) design has been pretty stable in the past few years, with most chip manufacturers following a similar multi-core design with many specialized blocks dedicated to offloading processing tasks from the central processing unit (CPU):

- Graphics Processing Unit (GPU): Responsible for accelerating visual calculations, especially 3D rendering.

- Image Signal Processor (ISP): Process data captured from the camera sensors.

- Digital Signal Processor (DSP): Process data obtained from other sensors, sometimes employed for media and/or communication processing.

- Neural Processing Unit (NPU) (aka AI Accelerator, APU for MediaTek): Specialized in artificial intelligence and machine learning tasks.

- Modem: Responsible for adding support for cellular networks (e.g. 4G/LTE, 5G Sub-6 GHz, 5G mmWave…).

CPU cores are commonly split between efficiency cores and performance cores, with the first consuming considerably less energy but not particularly fast. Heavier tasks are offloaded when necessary to the performance cores, with Android chips adopting a third tier of even faster CPUs denominated as “Prime cores”.

For almost 10 years, all smartphones from traditional brands have used the same CPU architecture: ARM. However, not all ARM CPUs are equal. Apple, for example, designs its own CPres compatible with the ARM instruction set, while the Android suppliers adopt reference CPU cores from ARM, known as the Cortex cores.

With the success of Apple’s in-house designs, both Qualcomm and Samsung are expected to once again offer custom ARM designs, something that mirrors the early days of Android SoCs with Qualcomm Krait and Samsung Mongoose cores. As of 2023, ARM’s reference cores for mobile processors are split between Cortex-X, Cortex A7xx, and Cortex-A5xx cores for prime, performance, and efficiency cores, respectively.

In the past three years, Android flagship SoCs had one main differentiating factor when compared to mid-range chips: The prime cores. Qualcomm’s launch of the Snapdragon 7+ Gen 2, however, made that distinction obsolete, but that chip still features a slightly less capable GPU, ISP, and modem compared to the company’s flagship offerings.

Production process

Another field in which Apple has the upper hand is the fabrication process it uses, more specifically, the preferential treatment it has with the world’s most advanced chip manufacturer, Taiwan Semiconductor Manufacturing Company (TSMC). Due to its sheer scale, with chips for smartphones, tablets, and now even PCs, Apple has dibs on using the newest process nodes from the Taiwanese company.

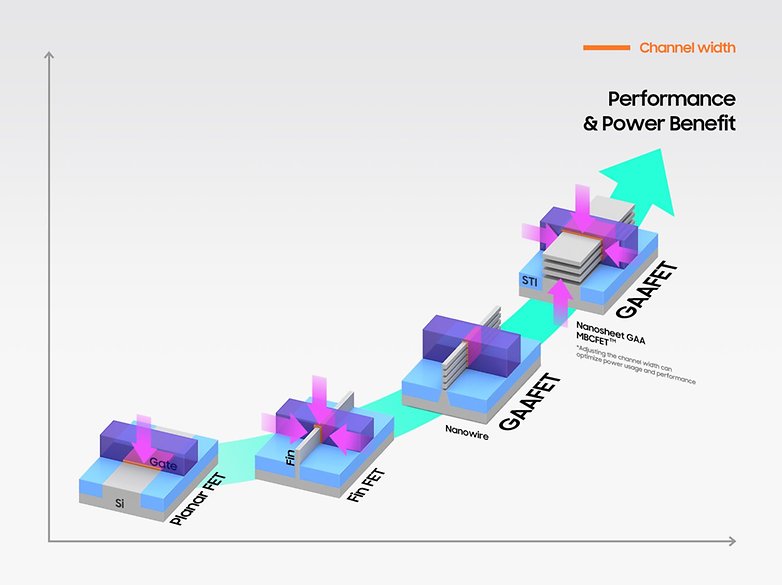

Newer processes usually translate into more transistor density—the ability to pack more cores, cache, and other structures, or simply fit more chips into the same area—, higher processing frequencies, and/or less power consumption

Apple had the first consumer processors made on TSMC’s 7-nm—technically announced after a Huawei Kirin chip, but reaching stores first—, 5-nm, and is expected to have the first smartphone powered by a 3-nm chip with the rumored Apple A17 processor on the 2023 update to the iPhone line.

MediaTek also has a strong partnership with TSMC, but usually is one process node behind Apple. In the past, the company was known for not having energy-efficient processors, but that was influenced by using outdated fabrication processes from both TSMC and UMC, also from Taiwan. The Dimensity chips, on the other hand, are fabbed using modern processes, making them competitive in energy consumption.

Qualcomm, for its part, usually maintains a foundry-agnostic strategy, with production booked according to availability. The Snapdragon 888/888+ and 8 Gen 1, for example, were made by Samsung Foundry, but their successor, the Snapdragon 8+ Gen 1 uses TSMC’s N4 process, resulting in less power consumption and heat dissipation.

Samsung’s in-house chips are obviously done by Samsung Foundry, which for the past few years has not been competitive with TSMC’s nodes from the same “nm” generation. The South Koreans are optimistic, however, that its 3 nm-class process will offer an 45% improvement in power usage, which would be a welcome evolution in mobile phones.

As for Google, since the Tensor mobile chips are based on Samsung LSI’s products, its first and second generation processors are also fabbed by Samsung Foundry, with rumors suggesting a future switch to TSMC, time will tell. Tensor chips usually distinguish themselves from Exynos SoCs by employing different CPU and GPU clusters, and most importantly, Google’s in-house Tensor NPU.

GPU trends

In the past two years, mobile processors joined the trend in PC GPUs to adopt ray tracing (RT) and other rendering features found in modern GeForce and Radeon graphics cards. Despite not expecting to see desktop-level graphics anytime soon in mobile devices, there were a couple of interesting developments that came with that trend.

The first one was AMD joining the mobile SoC space with its Radeon GPUs on the Samsung Exynos 2200, using the same RDNA2 architecture—although with far fewer cores—on the latest PlayStation and Xbox consoles. Samsung’s retreat from the flagship mobile SoC space, however, meant that it didn’t have a follow-up, with many rumors suggesting an Exynos+Radeon return in 2024 or 2025.

Qualcomm’s Adreno GPUs follow their own path, with very few publicly available details when it comes to specifications. Recent generations support ray tracing, alongside other advanced features, making them also suitable for use in other Snapdragon chips designed for Windows laptops.

MediaTek mostly uses ARM’s reference GPUs in its Dimensity range, with the newer Dimensity 9200/9200+ powered by the RT-capable Immortalis-G715 GPU. In the past, the Helio SoC family featured considerably fewer ARM Mali GPU cores than its Exynos and Kirin rivals, leading to lower performance, something that the flagship Dimensity models are changing thanks to a more premium positioning and advanced TSMC nodes.

Google doesn’t quite fit with other SoC brands in the Android space, going on a different pace on GPUs just like on the CPU cores. The Tensor G2 features a relatively low seven GPU cores from an older generation, so it is incompatible with the same features available on its rivals.

Apple doesn’t disclose much about its in-house GPU designs, which share a lot of history with old-school PowerVR video processors. iPhone GPUs are nevertheless very capable in terms of features, sharing their core design with the larger Apple M chips used on Mac PCs.

AI everywhere

With artificial intelligence (AI) and machine learning (ML) even more in the spotlight than in previous years thanks to Stable Diffusion and ChatGPT, the importance of AI-dedicated cores is only expected to increase. In that regard, flagship mobile chips have been getting increasingly more powerful in ML tasks thanks to dedicated cores such as Apple’s Neural Engine, Qualcomm’s Hexagon, MediaTek’s APU, and Google’s TPU.

Unfortunately, manufacturer-advertised numbers are not comparable between brands, with Apple announcing 16 trillion operations per second (TOPS) on its A16 Bionic chip, while Qualcomm’s numbers used to include processing done between the DSP, CPU, and GPU until the company stopped disclosing TOPS numbers for its Snapdragon chips.

Regardless, expect companies to keep advertising AI features on chips, throwing bold claims on performance improvements, while operating systems and apps try to catch up in supporting them.

Diminishing returns?

Flagship processors are bound to keep advancing in the next few years, especially with the return of custom designs from Qualcomm and Samsung, and AI taking the spotlight. However, it remains to be seen if software support will be able to keep up since those advancements usually take a lot of time to reach mainstream processors.

Additionally, more dedicated cores usually mean more transistors used, something that is not always economically viable without further advances in fabrication processes. Rumors around future generation chips getting more expensive persist, even if it is the type of information that is secretly held between chip and phone manufacturers.

On the other hand, past predictions about Qualcomm becoming a monopoly on Android’s flagship SoCs were wrong, with competition coming not only from Samsung but also from MediaTek and newcomer Google. It is a far cry from the competitive landscape from 10 years ago, but still some competition to look forward to.