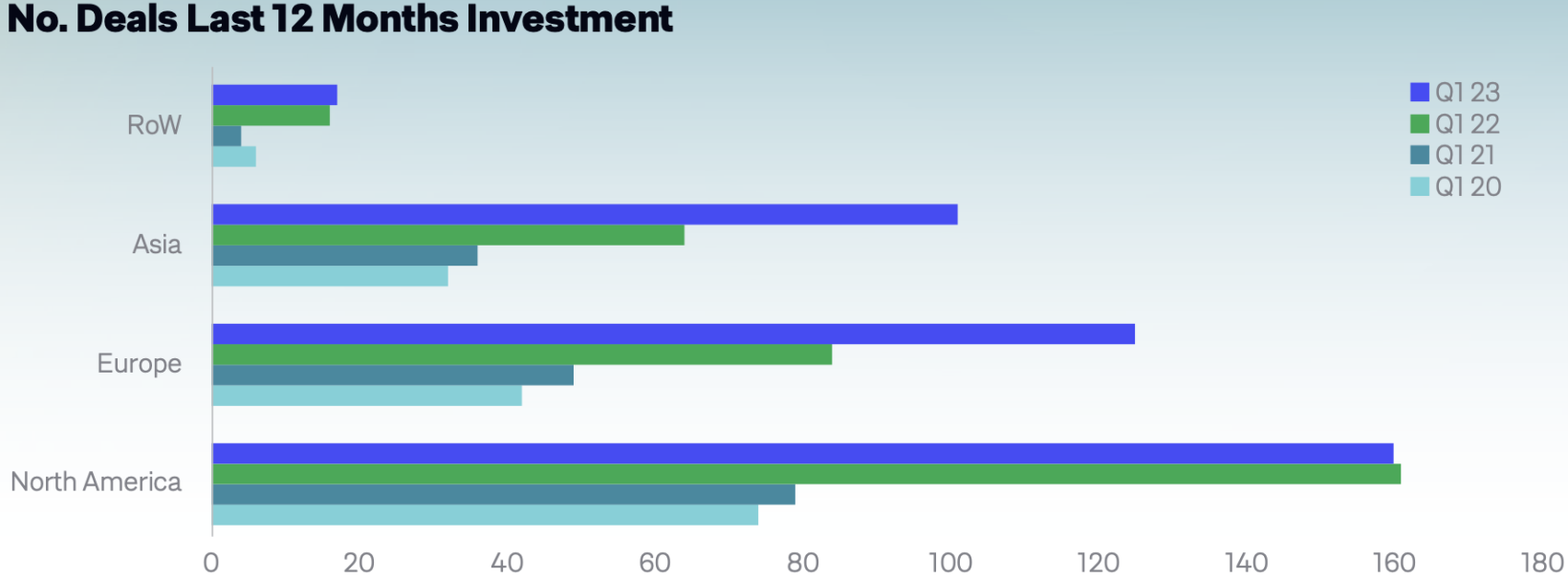

For the first time ever, Europe has surpassed the US in private spacetech investment, according to new research.

A study by Seraphim, a leading spacetech VC firm, found the European sector attracted $565m in the first quarter of this year. The whole of North America, meanwhile, raised $456m. Asia followed, with investments of $306m, while the rest of the world totalled around $29m.

The figures made Europe the world’s biggest market for private spacetech funding.

The quarterly investment in Europe hit almost 50% of the entire previous year. In contrast, US investment has fallen further compared to 2022. Asia was the only region that experienced growth last year, but could not maintain that trend last quarter, and lost its lead over Europe.

Serphim’s findings represent a rally in European investments — and a dramatic dip for the US.

Join us at TNW Conference June 15 & 16 in Amsterdam

Get 20% off your ticket now! Limited time offer.

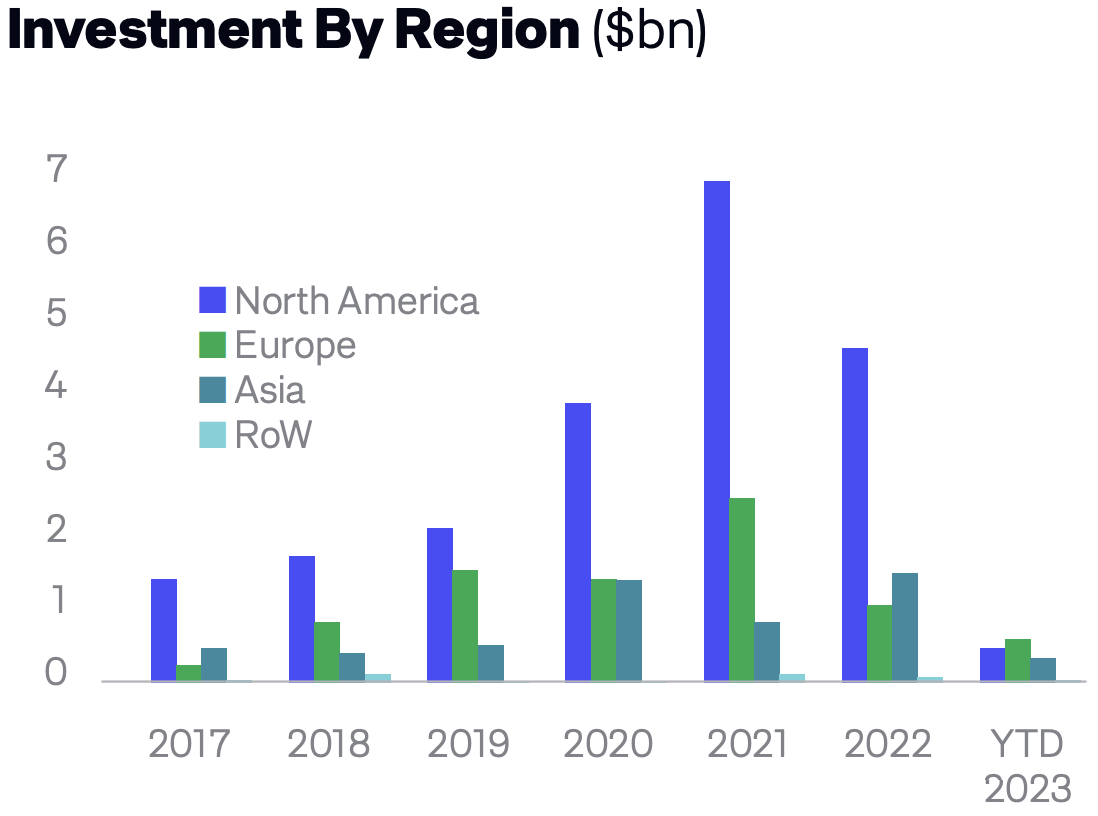

Over the previous year, the economic downturn had pushed funding down to levels last seen before 2021. According to Seraphim, growth investors have shifted towards earlier-stage deals to avoid high burn rates and capital requirements.

Growth-stage startups have also delayed fundraising. Instead, they’ve sought alternative financing sources and tried to extend runways until economic conditions improve.

Despite these challenges, Seraphim gave cause for optimism about spacetech funding. For one, investment and deal numbers remain well above historical norms.

Although funding has shrunk from the record highs of 2021 and 2022, those peaks were largely driven by mega-rounds from sector giants such as SpaceX, OneWeb, and Virgin Galactic. After adjusting for these outliers, Seraphim ranked Q1 2023 as the fifth-highest funding quarter to date.

Overall, activity in the space economy appears sustained. Rob Desborough, Managing Partner at Seraphim — and a speaker at last month’s TNW València — pointed to a “very significant rebound” this year — particularly in Europe.

“Investment was up 75% on last quarter with the highest number of deals [128] ever recorded,” Desborough told TNW. “As a global investor, what’s really exciting for us to see is the growth of activity in Europe.”

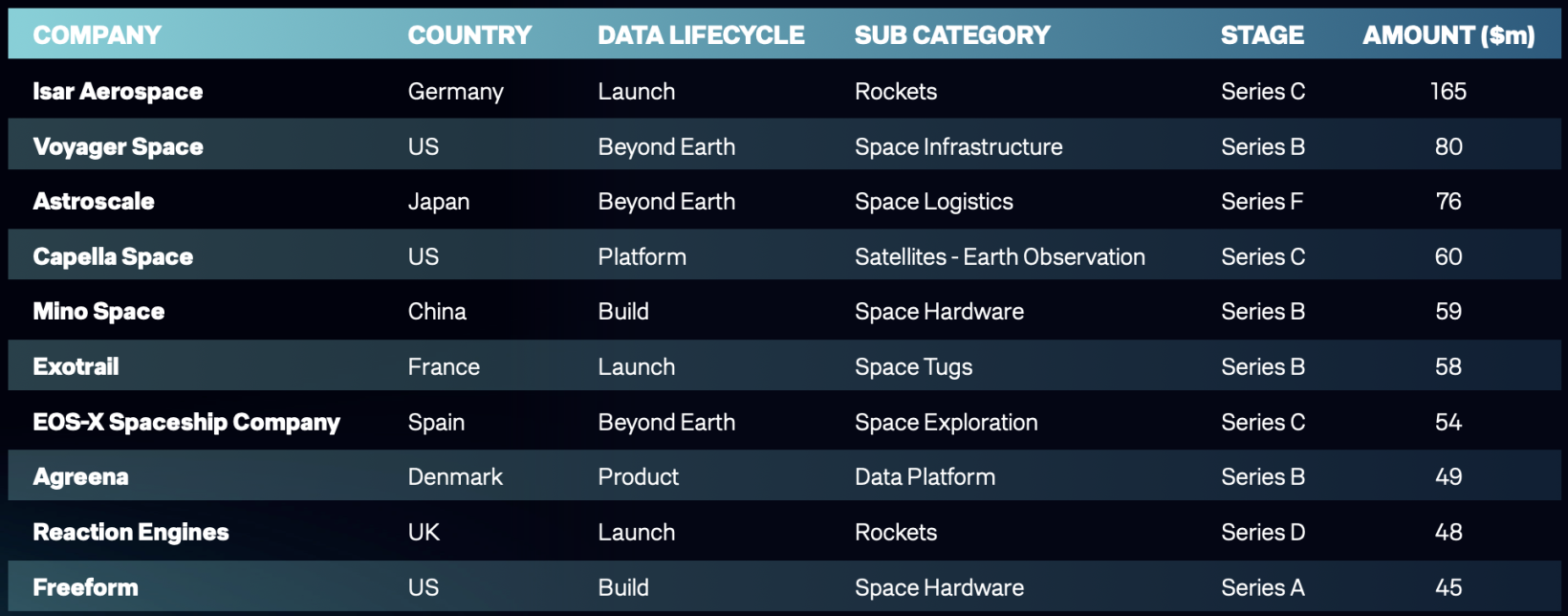

One reason for that excitement is found in spacetech’s biggest deals. European companies secured five of the top 10 investments last quarter — including the largest of them all: a $165m round closed by Isar Aerospace. The German rocket maker is the first European company to lead Serpahim’s rankings since OneWeb in Q3 2021.

As calls grow for European launch services to compete with US rivals, Isar can be upbeat about future funding opportunities. Indeed, the continent’s entire spacetech sector has been boosted by a push for sovereign capabilities.

“European governments have put an enormous focus on space sovereignty in launch, constellations, and communications in 2023, which is really catalysing investment,” said Desborough.

For investors, sovereign support for startups in emerging geographies can reduce their perceived financial risks. If the backing yields results, European spacetech could continue expanding across the cosmos.