The digital euro is edging closer to reality, despite concerns over the project’s privacy risks and functionality.

The European Commission on Wednesday proposed a legal framework for the electronic currency. Under the draft legislation, digital euros would be accepted for transactions anywhere in the eurozone, but cash would remain safeguarded as a form of payment. It would then be up to the European Central Bank (ECB) to decide if, and when, to issue the digital currency.

“In the euro area, the digital euro would offer a digital payment solution that is available to everyone, everywhere, for free,” said Valdis Dombrovskis, the European Commission’s executive vice president.

According to Dombrovskis, the project will modernise payments, enhance financial inclusion, and support innovation. He also emphasised the need to protect the eurozone from rival digital payment systems.

Crystals, jets, and magnets — is this how to make cooling greener?

“If other central bank digital currencies were allowed to be used more widely for cross-border payments, we would risk diminishing the attractiveness of the euro… and the euro could become more exposed to competition from alternatives such as global stablecoins,” he said.

Unlike cryptocurrencies, the digital euro would be backed by a central bank. That could reduce volatility, but it’s triggered anxieties about government control.

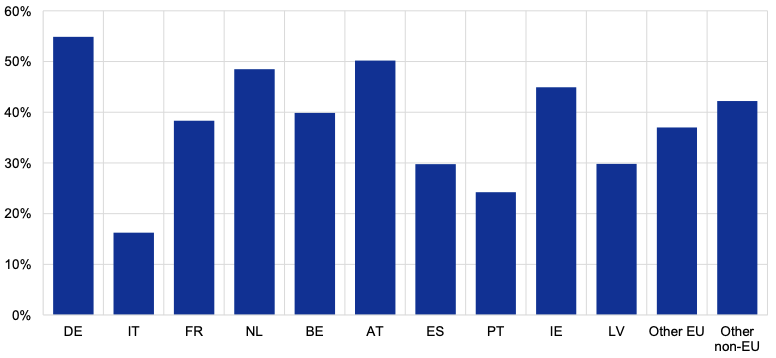

These concerns are prevalent across the bloc. In a consultation last year, 43% of respondents said privacy was what they wanted most from the digital euro. The next most desired features were security (18%), usability across the euro area (11%), absence of additional costs (9%), and offline use (8%).

Privacy advocates have raised fears about monitoring transactions and government control of personal finances. Other critics question whether the bloc needs its own digital currency. They argue that existing digital payments already provide sufficient functionality.

In response, the EU has added various safeguards and features.

To allay the privacy concerns, lawmakers have promised that ECB would not see users’ personal details or their payment patterns.

Users will also be able to pay offline. Officials say this will provide greater privacy than any current digital payment methods. They also argue that the digital euro will reduce payment-related fees for consumers by spurring competition for the likes of Visa, Mastercard, and PayPal.

Mairead McGuinness, the EU’s financial regulation chief, describes the digital euro as “a project of choice” rather than “a project of control. “

“By complementing cash, I have no doubt that a digital euro will bring advantages to citizens and businesses across the EU,” she said. “But I am aware that it requires peoples’ trust and confidence.”

That process remains a long way from completion. The proposal will now go to the European Parliament and EU member states for amendments, which provides another opportunity to address concerns.