Apple stock price dropped over 3% after it announced the results of its most recent financial quarter. But there’s good news mixed with the bad, and that shouldn’t be ignored. CEO Tim Cook and other executives stayed upbeat in a call with investors on Thursday, talking up strong iPhone sales, why Tim loves Apple silicon and more.

Here are the reasons for optimism we found in Apple’s quarterly financial results and call.

First the bad news

Here’s likely why AAPL dropped in after-hours trading: while revenue in the September quarter beat analysts expectations, it has now declined four straight quarters when compared to the same quarters of 2022.

And many people are nervous that China’s government officially disapproves of handsets from non-Chinese companies, so news that revenue in the country went down slightly is likely too making investors nervous.

But there’s good news from Thursday announcement, too.

1. Demand for iPhone 15 Pro and Pro Max is strong

Some recent published reports alleged that demand for the new iPhone 15 series is weak. Those are incorrect. The new handset helped set a September quarter revenue record for iPhone, and Apple now actually has the opposite of weak demand — demand for the high-end versions currently exceeds the company’s ability to make them.

“It’s correct that we are constrained today on iPhone 15 Pro and iPhone 15 Pro Max,” Chief Financial Officer Luca Maestri said during Thursday’s call with investors.

That’s actually good news and bad. It means Apple doesn’t have unsold inventory sitting on shelves. But it also means it’s having to delay sales of its products.

And it also means anyone planning to give an iPhone 15 Pro or Pro Max as a gift this holiday season should seriously consider ordering it early. –Ed Hardy

2. Apple expects a gangbuster quarter for Mac

Mac sales have been weak for the past year. Part of that is slow demand for computers — Mac and Windows — in the post-pandemic period. But the Apple M2 family of processors didn’t impress customers, that hurt sales of the MacBook Pro models introduced in January 2023.

But Apple just took the wraps off the significantly faster M3 family and put the chip in a lineup of MBP and iMac models. The company is now optimistic about a turnaround.

“We expect Mac year over year performance to significantly accelerate from the September quarter,” said Maestri in Thursdays call. –Ed Hardy

3. Tim Cook doubles down on Apple silicon’s staying power

Image: Apple

Apple CEO Tim Cook didn’t hold back when an analyst on the earnings call asked him what motivated the company’s move to Apple silicon as opposed to buying chips from vendors like Intel.

The typically long-and-winding analyst query touched on profit motive and customer satisfaction, then looped back around to wonder whether Apple might go back to getting its chips from other companies at some point.

“It’s really enabled us to build products that we could not build without doing it ourselves,” Cook replied. “And as you know, we like to own the primary technologies in the products, and arguably silicon is at the heart of the primary technology.”

But Cook didn’t leave it there.

“And so, no, I don’t see going back,” he said. “I am happier today than I was yesterday than I was last week that we made this transition and I see the benefit every day.” –David Snow

4. Apple’s Services juggernaut helps ease revenue doldrums

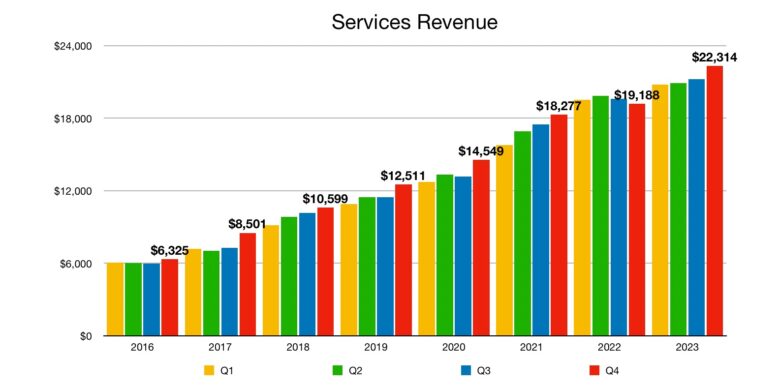

In an earning period that saw revenue declines extend into a fourth straight quarter, Apple still has bright spots — and one of the brightest lately is its growth in services.

“Services revenue set an all-time record of $22.3 billion, a 16% year-over-year increase,” Cook pointed out on the earnings call. “We achieve all-time revenue records across App Store advertising, Apple Care, iCloud payment services and Apple Music.”

Chart: Cult of Mac

Maestri underlined the services strength in his comments, noting that growth “accelerated sequentially from the June quarter, reaching all-time revenue records in the Americas, Europe and [much of] the Asia Pacific.”

“We also set new records in every services category,” he emphasized. That means there’s growth in Apple TV+ and Apple Arcade and more, not only the App Store.

Maestri further pointed out Apple continues to see increased customer engagement with services, with transacting accounts and paid accounts growing by double digits year over year to record highs.

Further, growth resulted in more than 1 billion paid subscriptions across services, almost double the number Apple had 3 years ago. And the outlook for Services remains strong, too, in the coming quarter.

“For our services business, we expect the average revenue per week to grow at a similar strong double-digit rate as it did during the September quarter,” Maestri said. –David Snow

5. Apple sees strong growth in powerhouse India market

Apple’s latest earnings call brought up India a lot because sales there — the world’s most-populous country as of June, even outdoing China — are among its strongest internationally, setting an all-time revenue record propelled in part by iPhone.

Meanwhile, others countries look on with mere September-quarter records — Brazil, Canada, France, Indonesia, Mexico, the Philippines, Saudi Arabia, Turkey, the UAE, Vietnam and more, Cook added. It’s quite a list.

Cook and Maestro both mentioned that Apple expanded its presence in India with its first-ever retail locations there, along with new stores in Korea, China and the UK, and new online shopping availability in Vietnam and Chile.

“We had an all-time revenue record in India, where we grew very strong, double digit,” Cook said. “It’s incredibly exciting market for us. And a major focus of ours. We have low share in a large market.” –David Snow